Source: Forbes —

The Bank of England raised interest rates on 15 December from 3.0% to 3.5%. The 0.5 percentage point increase marked the ninth rise since December 2021 when Bank rate stood at just 0.1%. It put the Bank rate at its highest level since 2008 and has applied further upward pressure on the cost of borrowing.

Volatility and uncertainty

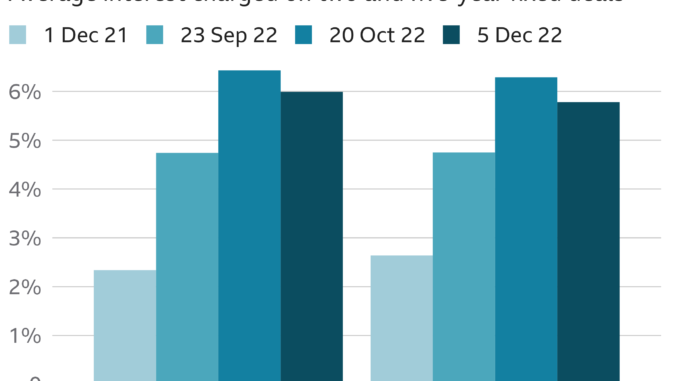

Mortgage costs also rocketed following last September’s ill-fated mini-Budget due to sterling volatility and market uncertainty. Major lenders including NatWest, Barclays, Halifax and Virgin Money all pulled deals and brought them back to the market at higher prices.

The appointment of Rishi Sunak as Prime Minister helped to settle the markets and the average cost of fixed rate mortgages has been continuing to come down from its peak.

Average costs of popular deals

According to our mortgage partner, Better.co.uk (formerly Trussle), the average cost of fixed rate deals across all deposit levels today stands at 5.10% (two-year fix), 5.02% (three-year fix) and 4.74% (five-year fix). This compares to highs of more than 6.50% in October.

Better.co.uk says the most competitive deals are 4.55% for a two-year fix and 4.33% for a five-year. Currently, long-term fixes are cheapest with the best 10-year fixed rate deal priced at 4.04%.

The average two-year tracker rate today stands at 4.09%, while a typical standard variable rate (SVR) is 6.31%, according to Better.co.uk.

Its data also shows that the average approved loan amount as of January 2023 is just over £200,000, against an average property value of £335,000.

At present, there are around 4,000 residential mortgage deals on the market. The number has increased since last Autumn’s mini-Budget when it plummeted to 2,560. Yet it’s still a far cry from the 5,300-plus deals on the market in December 2021, before interest rates began to climb.

A settling political landscape alongside a slight fall in the annual rate of inflation to 10.7% could ease pressure on the Bank of England to raise interest rates further in 2023. We’ve rounded up some expert opinion on how this could affect the mortgage market.

The next decision to be taken by the Bank’s Monetary Policy Committee (MPC) is scheduled for 2 February 2023.

Interest rates and mortgages

So what do rising interest rates mean for the cost of mortgages so far?

The estimated two million homeowners on variable rate deals, such as base rate trackers, will see an almost immediate rise in their monthly repayments following the latest Bank rate rise to 3.5%. As an example, a tracker rate rising from 4% to 4.50% costs around an extra £50 a month on a £200,000 loan.

The post What’s The Latest With UK Mortgage Rates? appeared first on Weekly Real Estate News.