The post These are the Most Vulnerable Housing Markets in America Right Now appeared first on Weekly Real Estate News.

The post These are the Most Vulnerable Housing Markets in America Right Now appeared first on Weekly Real Estate News.

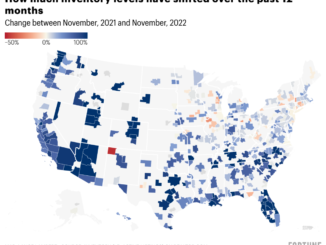

Source: Fortune — Nationally, home prices rose for 124 consecutive months between February 2012 and June 2022. Now we’re in reverse: Through September, the seasonally adjusted Case-Shiller National Home Price Index has posted three consecutive […]

As we celebrate Independence Day this year, it’s natural to reflect on the American Dream of homeownership. This dream, however, seems to be facing challenges. Fewer real estate transactions are occurring, and many are […]

Housing markets in tech hubs were in high demand during the pandemic, with potential buyers facing fierce competition on homes in cities like San Jose and Austin. But with the tech sector in turmoil, a […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes