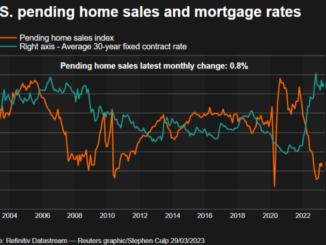

Stop me if you’ve heard this one before: home sales numbers continue to suffer due to a perfect storm of higher rates, lofty prices, and tighter purse strings driven by inflation. Ultra low inventory levels can’t be overlooked either. Any way you slice it, housing was booming at a frenzied pace by the end of 2021 and everyone simultaneously got the memo that it was time for things to cool off in 2022. In that sense, Pending Home Sales are no different than any of the other recent home sales data. They were very high and are now back in line with the lowest levels since the pandemic-related shutdowns in 2020. Unlike other recent home sales reports, Pending Sales is a bit more forward looking. In fact, it’s often thought of as a solid predictor for activity in the subsequent Existing Sales numbers. That’s bad because today’s release of November’s sales numbers showed a 4.0% decline versus a consensus forecast of -0.8%. It also brings the index below the lowest levels seen after the Great Financial Crisis. Long story short, this could suggest a similar dip is in store for the next Existing Home Sales report. But at this point, does an additional dose of weakness change the bigger picture? Not really. Being able to say “existing home sales fell below 2010’s lows” would just be a talking point and another way to state what’s already obvious. Home sales are searching for a floor. We’ll know it when we see it. Until then, we can only hope and assume that some relief in the form of lower mortgage rates and more even-keeled inflation would help both the demand and supply sides of the home sales equation.