This article is part of our 2022 – 2023 Housing Market Update series. After the series wraps, join us on February 6 for the HW+ Virtual 2023 Housing Market Update. Bringing together some of the top economists and researchers in housing, the event will provide an in-depth look at the predictions for this year, along with a roundtable discussion on how these insights apply to your business. The event is exclusively for HW+ members, and you can go here to register.

No one quite expected the antiquated wheels of housing, powered by paper, to drive the COVID recovery, but drive it did with record-setting origination. Fueled by the work-from-home exurb mania which joined forces with the newly minted individual and institutional passive investors, outsized demand was created that defied demographics.

And with government stimulus in the form of direct transfer payments, mostly forgiven PPP loans and low rates, we blew past and through all our metrics, as home prices increased at a rate not seen in recent U.S. history.

By the time the Fed arrived to remove the punchbowl, affordability had been decimated In the U.S., planting us firmly in the first days of 2023 where higher rates and prices threaten to completely paralyze the housing market. Current sentiment swings between utter doom to what most are labeling as misplaced optimism. However, the story of 2023 may be very different than what any of us expect due to the oncoming avalanche of inventory we may see and its implications.

You have probably heard that low housing inventory got us into this mess. Esteemed housing analyst, Ivy Zelman, known for calling the last housing top as well as this one, has a different view. She argues that we don’t really have the data and as houses turned so quickly, the fog of war is precluding our exact understanding of what happened. Recency bias, or the belief that recent events will occur again soon, keeps many of us, like the Fed, looking through the rearview mirror, missing what’s ahead.

We are now all too familiar with the beating drums of rate hikes, ‘big R’ or ‘little r’ recession and the affordability crises — all to a rhythm we cannot control. But, if we pay attention, we can catch and manage the new opportunities and realities which will be driven by the following themes:

Increased inventory from short-term-rental gone wrong, aka the Airbnb bust.Investors offloading negative cash-flowing properties to avoid margin calls and unhappy investors. Increased inventory from robust construction of new, single-family homes with “motivated” sellers. Increased inventory from Boomers hoping to catch their cash from 2nd homes against deflating rental income, stubborn inflation and falling home prices. Lagging, but potential inventory from newly-converted commercial spaces left empty by remote work and urban flight in the hardest-hit areas. And finally, decreased demand due to aging demographics.

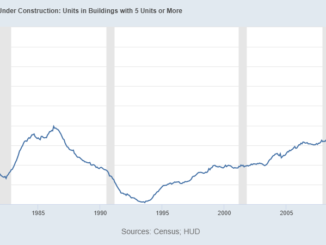

Multi-family property construction is the highest since the 1970s amidst an aging demographic, rents are going down and with it, investor appetite. And, much of the construction market is holding on for dear life with Build-to-Rent, so we could see distressed single-family inventory hitting the market at a pace not seen before.

No one believed home prices could rise as fast as they did, nor should they believe there is some hidden law of physics that will preclude prices going down in some markets at the same rate-of-change if not faster, increasing appetite for market participants who cannot outwait the Fed due to the three D’s: death, divorce, default.

With all-cash sales accounting for an estimated 30% in the final days of the boom, the delays caused by the laborious, highly-regulated default process will not impede listings from individual and institutional investors who likely took on leverage through revolving credit lines, crypto loans, personal loans or loans based on their equity holdings, all of which have been significantly impacted by rate hikes or adverse market events.

No one has a crystal ball, and our current reality can change quickly based on exogenous events such as the Russia-Ukraine conflict, the esoteric signaling from the Fed or rising tensions with China. Predictions are pointless if they don’t pay the bills, so our focus should turn to the probable paths based on the information we do have. We should ready the forces for all potential outcomes.

2023 will not be boring, and it will likely be filled with conflicting signals just as 2022 was. But, despite innovations and changing trends, housing is about housing our populous. And right now, that populous is largely aging, retiring and consolidating with very few able to afford and maintain a 2nd home.

Consequently, the priced-out participants we all saw turn away, dejected, from the market will become our bread and butter. Stable earners will stomach higher rates (to a point). So, perhaps the heady days of exploding profit margins and voracious gain-on-sale are behind us, but 2023 has the potential to be busy and profitable for those paying attention — the positioned few who can profit from changing trends rather than being trampled by them.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com