The post 30-year fixed mortgage rates still ‘keeping some people away’ from buying a house: Realtor appeared first on Weekly Real Estate News.

The post 30-year fixed mortgage rates still ‘keeping some people away’ from buying a house: Realtor appeared first on Weekly Real Estate News.

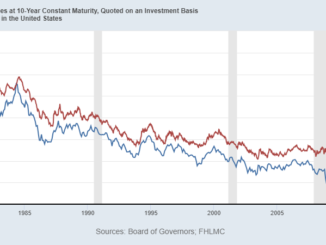

Mortgage rates fell this week as the October inflation report drove down the yield on the 10-year Treasury. On Thursday, investors priced in a 99.7% chance that the Fed will hold interest rates steady in […]

The CPI data released today shows the growth rate of inflation cooling off, and that’s good for mortgage rates. If inflation were running hot like in the 1970s, mortgage rates would have easily gotten to […]

Mortgage rates were in decline for the first time since March, according to the latest Primary Mortgage Market Survey from Freddie Mac (OTCQB: FMCC). The 30-year fixed-rate mortgage averaged 7.09% as of May 9, down […]

Copyright © 2025 | MH Magazine WordPress Theme by MH Themes