Interest rates and inflation continued to dampen activity in the housing market across all 12 Federal Reserve districts, according to the Fed’s latest Beige Book.

“Higher interest rates further dented home sales, which declined at a moderate pace overall but fell steeply in some Districts,” the report states, noting that “residential construction slid further at a modest pace” and “home prices grew less rapidly or declined outright amid weak demand.”

Higher mortgage rates, inflation and recession fears are the key factors holding back home demand in districts including Boston and Philadelphia, said the economists, market experts and business organization leaders interviewed for the report.

In the New York and San Francisco districts, potential homebuyers opted to rent instead of purchasing due to elevated prices and higher mortgage rates. Following dampened activity from buyers, sellers provided increased concessions, such as temporary rate buydowns or paying closing costs to complete sales, the report noted.

The economic outlook remained dim – “interest rates and inflation continued to weigh on (economic) activity,” interviewed experts said, and “expressed greater uncertainty or increased pessimism.”

In the Dallas district, housing outlooks worsened, with those interviewed expecting “further erosion in sales and home starts in the near term.”

Fannie Mae also had a gloomy outlook for the housing market next year, citing lower home sales and mortgage origination activity compared to 2022 amid elevated mortgage rates.

Single-family home sales are projected to drop to 4.42 million in 2023 from 5.67 million this year, and mortgage origination activity is forecasted to slip to $1.74 trillion from $2.34 trillion.

Mortgage rates, affected by inflation and higher interest rates, have been on a declining trend in recent weeks after peaking about a month ago at 7.16%. Following October’s inflation slowdown, the Fed indicated smaller interest rate hikes in December following its four successive raises of 75 basis points. (The Fed’s short-term rate does not directly impact long-term mortgage rates, but it does steer market activity to create higher rates and reduce demand.)

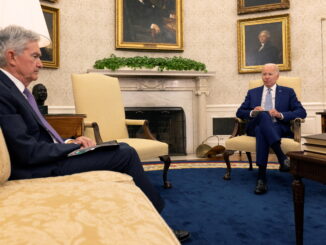

“The time for moderating the pace of rate increases may come as soon as the December meeting,” Fed chair Jerome Powell said Wednesday in his final public remarks at Brookings Institution before the Fed’s meeting on December 13-14.

Lower rates have already impacted purchase demand, which have risen for four consecutive weeks, Logan Mohtashami, lead analyst at HousingWire, said.

“If rates can keep heading lower, toward 5%, that can stabilize the housing market which is still in a recession,” Mohtashami said.

Fannie Mae forecasts mortgage rates to pull back over the next two years. This reflects a view of moderating 10-year Treasury rates as the Fed Reserve eventually ends its tightening stance, as well as a contracting economy and compression of the Treasury-mortgage rate spread once interest rates stabilize.

The information and data for the current Beige Book – released in November – was collected on or before November 23. The Beige Book reports, published eight times a year, are based on interviews with bank directors, business and community organization leaders, economists, market experts, and other sources.

Following are excerpts of statements on housing conditions from each of the 12 Federal Reserve districts – drawn from the recently released Federal Reserve Beige Book.

***

Boston – The First District’s residential real estate market continued to weaken in September and October … Closed sales were down over-the-year in all reporting markets (which exclude Connecticut), representing a moderate deceleration in sales for single-family homes and a substantial deceleration for condos. Contacts continued to cite sharply higher mortgage rates, inflation, and recession fears as the key factors holding back home demand. Inventories fell again on a year-over year basis in most markets.

New York – The home sales market weakened noticeably in recent weeks, and the rental market showed signs of softening. With homes now taking longer to sell, many sellers have taken their homes off the market. Residential rental markets have weakened, except at the high end of the market, where many potential buyers are instead opting to rent. Overall, rents across New York City have declined, and concessions have edged up for the first time in a year.

Philadelphia – Homebuilders reported that contract signings for new homes plunged after declining slightly in the prior period. Their current backlog will carry construction through the first quarter with only a modest decline in activity, but not much further. Existing home sales fell steeply in most markets. They (brokers) noted that high prices combined with rising interest rates have reduced housing affordability significantly and have driven potential buyers from the market.

Cleveland – Housing demand continued to decline from levels that were already down significantly from recent peaks. Contacts noted that many potential buyers have found it difficult to qualify for mortgages amid higher interest rates. Contacts did not expect demand would improve soon because interest rates are expected to remain high. One real estate agent stated that “the snowball will continue to roll down the hillside with nothing to stop it.”

Richmond – Demand for housing slowed considerably this period with reduced buyer traffic and listings. Days on market and inventory levels have increased but were still below normal levels. Respondents indicated that there were fewer closed and pending sales due to higher interest rates and low inventory. In most markets in the Fifth District, home prices remained unchanged, but sellers were offering more concessions, such as temporary rate buydowns or paying closing costs, to complete sales. Buyers were not having any difficulty obtaining mortgages and there were no issues with appraisals. New home construction also slowed down this period, and builders were no longer acquiring new lots due to high building costs and economic uncertainty

Atlanta – Housing demand continued to deteriorate as mortgage rates rose and affordability further declined. Existing home sales dropped sharply and inventory levels rose in most markets. Although home prices remained above year-ago levels, monthly sales price growth continued to moderate. The new home market decelerated at a faster rate, with a sharp decline in new orders and a rise in cancellations. Builders pulled back on starts but the inventory pipeline remained elevated, with the bulk of units to be delivered through the first quarter of 2023.

Chicago – Residential construction moved down modestly, largely in the single family segment. Delays and cancellations increased for both single- and multifamily projects. Homebuyers were shocked by how quickly mortgage rates had risen, according to a contact. Home values were down modestly, but rents were up again.

St. Louis – The residential real estate market has slowed modestly since our previous report. Contacts reported demand has slowed due to 7-percent mortgage rates. Pending home sales have decreased and inventory is up. Louisville contacts reported closings are down about 30 percent in the past few months.

Minneapolis – Single family permitting levels were notably below year-ago levels in most parts of the District. Residential real estate continued to decline. Closed sales in October were widely lower across the District compared with last year, and often by sizable amounts, including 31 percent across Minnesota. Contacts in Montana reported that banks were laying off several dozen staff related to slowing mortgage activity.

Kansas City – Multifamily housing real estate activity declined abruptly in recent weeks. This decline arose despite a backdrop of elevated demand for housing across the District and declining prices for construction materials. The downshift was attributed solely to higher interest rates and the outlook for higher rates over the near term.

Dallas – Sales slipped again and contract cancellations stayed elevated as high mortgage rates priced buyers out of the market. Among the major Texas metros, Austin appeared to be the roughest market and was experiencing larger price declines to generate sales. Buyer incentives increased notably, putting downward pressure on home prices and builders’ margins. Outlooks worsened, with contacts expecting further erosion in sales and home starts in the near term.

San Francisco – Demand for single-family homes fell overall due to elevated prices and rising mortgage rates. One contact in Southern California noted that potential homebuyers have opted to rent instead, and a Northern California contact reported a change in scope for some single family construction projects, now built to rent rather than to sell. Selling prices across the District remained high but began to stabilize, with price reductions in some markets. Across the District, inventories remained limited but increased somewhat in recent weeks as homes took longer to sell. Residential construction activity declined notably across the District.