I have been part of the mortgage banking industry since 1983 — 39 years to date through different housing markets. And while my more recent roles were more senior in stature, my mind tends to think like I did when I was a top loan originator in Denver back in the very beginning.

In fact, it was the skills I developed selling loans that helped develop my ability to influence policy leaders and others in industry during my time as Federal Housing Commissioner and as CEO of the Mortgage Bankers Association. Selling loans or influencing policy leaders is nothing more than selling an idea and providing the leadership so that other people will agree.

So when I talk to loan originators today, I harken back to my early days when fixed mortgage rates were over 14% and there were absolutely no refinances to be had. In many ways it was similar to today, with one exception: When I started, I hadn’t been spoiled by a housing market like the one in 2020 and 2021. I hadn’t been fed refinance volumes the likes of which had never before been seen in the US.

Frankly, I think the Federal Reserve over-shot the market and as a result it did a huge disservice to the U.S. economy, especially the mortgage and housing sector.

It created a massive demand for home purchases as consumers competed to win a sales contract and get a home with a low single digit interest rate. It resulted in outrageous house price appreciation of approximately 34% nationally in just a two-year period. It boxed out many first-time homebuyers who found themselves unable to compete against buyers willing to place a non-contingent offer above full price.

But what’s worse is that the Federal Reserve, along with the stimulus legislation provided by Congress in response to covid, put an excessive amount of spending power (cash) in the hands of consumers.

The spending spree caught an entire nation off guard as it was underprepared to support the massive demand for goods and services. Supply chain shortages, many of which remain still today, meant that everything from new cars to basic random length lumber costs skyrocketed.

The nation, exhausted with two years of cabin fever due to covid, began traveling literally everywhere all at once. The subsequent shortages in labor to staff airports, airlines, hotels, restaurants, and more drove prices up and availability down.

For mortgage lenders, the result is akin to having an all-night binger in college only to be faced with a horrific hangover the next day. It means a massive contraction in demand for mortgages, tighter margins, corporate layoffs and “right-sizing,” and concerns about what the future may hold.

Many loan originators who were the most dependent on refinance volume woke up in 2022 only to realize that the skill sets to sell a mortgage via a Realtor or other referral partner in a rising rate market is entirely different from refinancing someone into a 2-3% mortgage rate.

But to all loan originators, let me remind you of a few key points:

1. The housing market won’t be like this forever.

As quickly as rates dropped in March of 2020, as quickly as they rose in 2022, markets shift. Glenn Stearns, founder and CEO of Kind Lending, is a regular TikToker and in one video he was asked the most important lessons he learned in business and his response was “This too shall pass.”

Just as the Fed overreacted with stimulus, they are likely overreacting in their quantitative tightening, meaning mortgage rates are certain to come down, likely later next year. In fact, the chief economist at the MBA forecasts rates in the mid 5% range by end of year next year. Things will get better.

2. You have one huge advantage over anyone else who is in any sort of “sales” role.

A prospective homebuyer, even one sitting on the sidelines right now due to fear and emotion, has one key difference. They want to own a home. The product is already sold. There is no need to convince them that they should want to be a homeowner.

In fact, over 90% of Americans want to own a home at some point. Concerns about home prices, mortgage rates, qualifying, and more may be holding them back. But they are already sold on the product. That’s a huge advantage.

3. Data can help you right now.

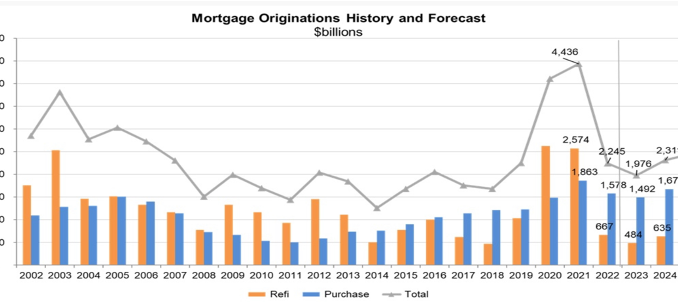

The housing market is simply not that bad. In fact, even though the MBA just lowered its forecast for 2023, the forecasted volume will still make next year one of the best mortgage years in the last 20 years. In fact, while in won’t match 2020 or 2021, purchase mortgage dollar volume should be better than any year from 2002–2020.

And this industry made good margin and good incomes through most of those years (Great Recession aside). So as the industry right-sizes, which is happening rapidly, margins will return and we will have some solid years ahead.

4. Potential homebuyers want to buy.

The media and hyperbole are scaring potential homebuyers to the sidelines, but betting on home values is one of the greatest bets someone can make. When mortgage rates come down, homebuyers will come out in droves and it will be a sellers’ market again.

Buying now means being able to negotiate as a buyer. And one thing that history shows, as the graphic below from the Federal Reserves (FRED) site illustrates, is that home prices always go up. Even considering the eight recessions since 1960, home prices always recover and go higher. So trying to time the housing market is like timing Bitcoin.

There is absolutely no certainty to timing. But with single-family housing in this country, median prices only go up over time.

5. The years ahead will bring strong demand.

As Mark Zandi, the chief economist for Moody’s Analytics, said in a recent presentation, millions of Americans are about to come into the median age for first-time homebuyers: age 34. The population age distribution should result in a steady demand as millions of Millennials are now aging into that critical age range. In fact, this is the biggest population wave to age into their home-buying years that the nation has ever seen.

The psychology of our industry — of loan originators and Realtors — can be so emotional when things are not working perfectly. But this is when true professionals double down.

Those that engage in more consistent sales activities and bring value-added concepts, some of which are right here in this article, will be the ones that help motivate those in this market. Practicing optimism and looking for good data to support your efforts is critical to success.

The industry has its cycles, but just remember: the housing market’s overall size next year will be a pretty strong market historically, home prices always go up over time, the demand wave due to demographics is simply irrefutable, and of course “this too shall pass.”

David Stevens has held various positions in real estate finance, including serving as senior vice president of single family at Freddie Mac, executive vice president at Wells Fargo Home Mortgage, assistant secretary of Housing and FHA Commissioner, and CEO of the Mortgage Bankers Association.

This column does not necessarily reflect the opinion of HousingWire’s editorial department and its owners.

To contact the author of this story:

Dave Stevens at dave@davidhstevens.com

To contact the editor responsible for this story:

Sarah Wheeler at sarah@hwmedia.com