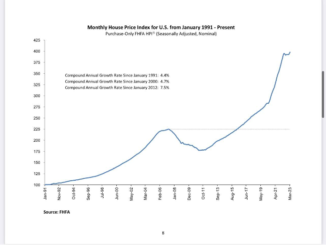

Black Knight released its Mortgage Monitor report today–always a treasure trove of robust housing/mortgage-related data. Of particular interest this time around is the ongoing price declines seen in Black Knight’s Home Price Index (HPI)–especially as they relate to the recent FHFA HPI data that influenced new conforming loan limits. To be clear, today’s HPI from Black Knight is for October whereas last week’s FHFA HPI data was for September. It’s nonetheless interesting because the sort of full-fledged price rebound seen in the FHFA data (Q3 miraculously came in slightly HIGHER than Q2) is nowhere to be found in any of the other data. NOTE: FHFA’s own monthly HPI data suggested declining values in Q3 but the conforming loan limit is based on expanded quarterly data which includes more lower priced homes which would indeed be less likely to show the same level of price declines as higher value homes. Disclaimers aside, the notion of higher prices in Q3 vs Q2 doesn’t jive with any of the other data. The point of comparing Black Knight’s latest data to FHFA is simply to illustrate the mystery can’t simply be chalked up to timing. That said, the Black Knight data agrees that price declines have begun to slow. In the month of October, the HPI fell 0.43%, but in seasonally adjusted terms, the decline was only 0.13%. That makes October the best month since prices began declining in July. This took the annual appreciation rate down to 9.3% (still exceptionally high) from 10.6% in September.