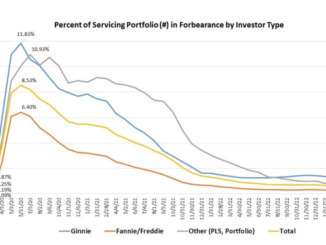

The forbearance rate increased marginally in October after more than two years of declines, the Mortgage Bankers Association (MBA) reported Monday. The trade group previously noted that it expected pressures due to worsening economic conditions.

The total number of loans in forbearance in October increased to 0.70% of the servicers’ total portfolio volume, up one basis point from the month prior. As of October 31, there were 350,000 U.S. homeowners in forbearance plans, up from 345,000 at the end of September.

The most significant increase came from Ginnie Mae loans in forbearance, which increased to 1.41% in October, up eight basis points compared to one month prior. Fannie Mae and Freddie Mac loans in forbearance also increased in October by one bps to 0.31%.

Meanwhile, portfolio loans and private-label securities (PLS) dropped 11 bps from the previous month, ending October at 1.03% of the servicers’ total portfolio volume.

“Several factors were behind the first monthly increase in forbearances in 29 months, including the effects of Hurricane Ian in the Southeast, the diminishing number of loans bought out of Ginnie Mae pools and placed in portfolio, and the fact that new forbearance requests have closely matched forbearance exits for the past three months,” Marina Walsh, MBA’s vice president of industry analysis, said in a statement.

With the COVID-19 federal health emergency still in effect, borrowers can continue to seek initial COVID-19 hardship forbearance. Homeowners can also get a forbearance plan due to natural disasters or other causes.

How borrowers can stay afloat with home equity products during difficult economic times

Some homeowners are confronting a difficult choice: sell or face foreclosure. Learn what lenders can do to help borrowers facilitate a sale, protect the equity in their home, and potentially remain in their home following the sale by negotiating a leaseback option.

Presented by: Altisource

According to the data, the total for loans serviced that were current last month – which means not delinquent or in foreclosure – reached 95.7% of the portfolio, a decline of 15 basis points compared to September.

In total, 44 states reported declines in the share of loans that were current in October.

“Florida, which was hit the hardest by Hurricane Ian, experienced a 49-basis-point drop in the share of current loans – the biggest decline of all states,” Walsh said.

The survey showed that 36.7% of total loans were in the initial plan stage last month and 50.9% were in a forbearance extension. The remaining 12.4% represented re-entries.

From June 2020 to October 2022, MBA data found that 29.6% of exits resulted in a loan deferral or partial claim, while 18.3% of borrowers continued to pay during the forbearance period. However, about 17.3% were borrowers who did not make their monthly payments and did not have a loss mitigation plan.