The National Association of Realtors (NAR) reported today on two trends in existing home sales that we have seen for many months now: sales are declining while total inventory data has fallen directly for the three straight months. On a positive note, however, the days on the market are no longer a teenager anymore: that metric grew from 18 days to 21 days.

I cheer because the savagely unhealthy housing market theme I talked about back in February of this year was the same premise of the housing reset talking point the Federal Reserve uses. Total inventory data started at all-time lows at the beginning of 2022, creating more bidding war action in January and February, peaking in March.

We needed to end this madness before we had prices escalate over 20% for another year. The Federal Reserve wanted to see the bidding wars end and the days on the market grow. This is happening, and in the long run, this is a plus for the housing market.

When I outlined my 23% five-year growth model for 2020-2024, it was to have a marker for when price growth got too hot. I didn’t have to worry about this in the previous expansion — as my long-term work stated for a decade, the years 2008-2019, would have the weakest housing recovery ever.

We don’t have any housing bubble or overheated demand data, nor can we. This article, which I wrote in 2019, does show you the historical work in the past decade on the housing bubble talk.

However, I knew the years 2020-2024 would see better demand from the bump in demographics. This could potentially put us in a horrible place with inventory, which it did, and prices accelerated beyond my five-year price-growth model in just two years. I am staying consistent with my work and model when I described the housing market in February as savagely unhealthy.

Soon after, the Fed came in with their housing reset premise. Now we are getting the call back to balance, which is good. The positive aspect of today’s data line is that the days on the market grew again, and we are getting off the teenager level.

NAR Research: First-time buyers were responsible for 28% of sales in October; All-cash sales accounted for 26%; Individual investors purchased 16%; Distressed sales represented 1% of sales; Properties typically remained on the market for 21 days in October.

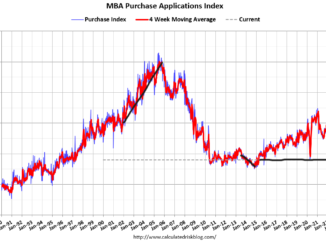

One thing about housing data we all need to be mindful of is that the year-over-year comps will be very challenging until we get to the end of January. Last year starting in October, purchase application data had an abnormal volume rise toward the end of the year. Even though the data was still showing negative year-over-year prints due to COVID-19 comps, the percentage was getting less and volumes were growing.

It was a funky time with housing data last year; people needed to make COVID-19 comp adjustments. As mortgage rates rose more and more, the October to January data was going to show big negative prints.

NAR Research: Total existing-home sales decreased 5.9% from September to a seasonally adjusted annual rate of 4.43 million in October. Year-over-year, sales dropped by 28.4% (down from 6.19 million in October 2021).

I anticipated purchase application data to have 35% to 45% year-over-year declines starting in October. That has occurred right on schedule; the last print came down 46%. If housing data takes another leg lower, we would see negative prints of 53%-57%. The last two weeks have had positive weekly data of +1% and +4%.

Total housing inventory fell in this report, the third report in a row that shows total inventory has decreased. Seasonal impacts are the norm with housing, and new listing data is negative 6% year to date.

We saw new listing data decline when rates got to 6.25% the first time. This is not a positive for the housing market. A traditional seller is primarily a homebuyer, so not only do we lose the inventory for sale when this happens, but we also lose a buyer. This is another factor in driving purchase application data below 2008 levels. However, as we can see, the inventory data looks much different than what we saw in 2000, 2005, 2008, 2012, 2015 and 2018.

NAR lists the current inventory at 1.22 million, while historical normals are between 2 million to 2.5 million, with a peak in 2007 a tad over 4 million. The monthly supply grew from 3.2 months to 3.3 months.

Price growth has been cooling off more noticeably, similar to other periods when mortgage rates rose. However, the extreme level of price growth we had earlier this year was savagely unhealthy, so this news isn’t just welcome — it’s needed to bring balance back.

NAR Research: The median existing-home price for all housing types in October was $379,100, a gain of 6.6% from October 2021 ($355,700), as prices rose in all regions.

With today’s report, we see the continued trend of demand destruction from higher rates and a lack of new listing growth. The severely unhealthy housing market is returning to a B&B marketplace, boring and balanced, but still needs more time.

The parts of the country at 2019 inventory levels are already off my savagely unhealthy list; the rest are still struggling to get more new active listings. The Federal Reserve can help the housing market by saying one sentence about the pivot; however, it’s not there yet, and housing market inflation is their big concern.

Going out for next year, though, the rent inflation data is lagging on the CPI data and is already showing a cooldown. We see the inflation growth rate falling in other data lines as well.

If mortgage rates can get down toward 5%, we can see some stabilizing in the housing data that is working from a much lower bar now. This is the way to get out of the housing recession that started in June.