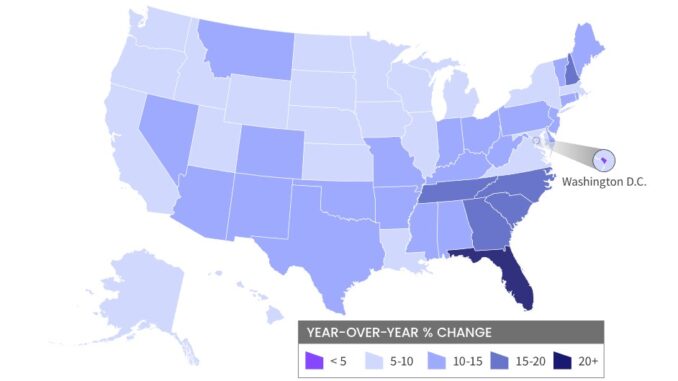

Annual home price growth remained in double digits in September even as home sales and purchase mortgage volume continued their months’ long declines. The CoreLogic Home Price Index (HPI), the earliest look each month at prices two months prior, rose by 11.4 percent in September 2022 compared with the same month in 2021 . While appreciation remains high, even in the face of skyrocketing mortgage rates, they have declined significantly from the annual pace in both March and April of 20.9 percent. Month-over-month changes turned negative in July. From August to September the growth rate declined by 0.5 percent. Selma Hepp, CoreLogic’s Deputy Chief Economist said,” The rapid increase in prices during the COVID-19 pandemic caused many U.S. housing markets to reach completely unaffordable levels for potential local homebuyers. On the West Coast and in Mountain-West states, home prices are slowing from this spring’s high but remain elevated from a year ago. By contrast, markets that continue to see an in-migration of higher-income households are still experiencing home price gains that are notably higher than the national rate of appreciation.” CoreLogic said the states in the Southeast may be the beneficiaries of this out-migration. Home prices in more expensive states on the West Coast and in the Northeast are likely fueling homebuyer enthusiasm for properties in relatively more affordable areas . Florida has led the nation in home price growth for eight consecutive months.