Economic uncertainty, inflation, and rising mortgage rates are clouding the picture for the U.S. housing market, which is also facing a structural deficit of both for-sale and rental homes. During the “Getting Serious About Housing Supply: The State of the U.S. Housing Market” webinar hosted by the Bipartisan Policy Center, Jeff Tucker, senior economist of economic research at Zillow, and Caitlin Sugrue Walter, vice president of research at the National Multifamily Housing Council (NMHC), shared the current conditions and challenges facing the home buying and rental sectors, respectively.

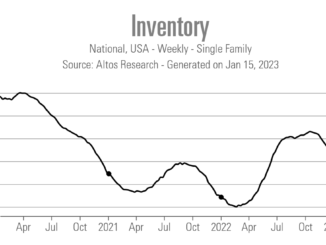

In the single-family for-sale market, Tucker said the past two years of home price growth has pushed unaffordability to a “crisis stage.” The rise in affordability concerns has resulted in potential buyers becoming discouraged, causing sales volume to fall, and increasing inventory on the market.

“When we try to put all this competing information together, demand is stepping back in the face of affordability challenges [and] inventory is rising but not skyrocketing; what our model says is prices may dip seasonally for the remainder of the year, then have a seasonal bounce back in the spring [of 2023]. It’ll look like a bit of a seasonal plateau—flat, but with some seasonal growth,” Tucker said.