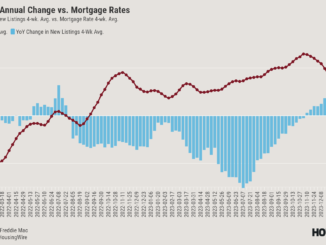

Mortgage rates appear to be settling in the 5% range after recent dramatic climbs that shocked home buyers. The 30-year fixed-rate mortgage averaged 5.13% this week, down slightly from its 5.22% average a week ago, Freddie Mac reports.

Mortgage rates peaked at 6% in early June, which prompted a pullback in housing demand. However, “home sales may soon stabilize since mortgage rates have fallen to near 5%, thereby giving an additional boost of purchasing power to home buyers,” says Lawrence Yun, chief economist for the National Association of REALTORS(R).

Inflation appears to have peaked, which has stopped the rapid increase in mortgage rates, says Sam Khater, Freddie Mac’s chief economist. “The market continues to absorb the cumulative impact of the large price and rate increases that led to a plunge in affordability,” Khater says. “As a result, over the rest of the year, purchase demand likely will continue to drag, supply will modestly increase and home price growth will decelerate.”

Total mortgage demand fell to its lowest level in 22 years last week, the Mortgage Bankers Association reports. A big contributor is falling refinance applications, as homeowners have less incentive to refinance due to higher rates. Still, mortgage applications to purchase a home are 18% lower than a year ago as more buyers step away due to higher mortgage rates and inflation, the MBA reports.

Freddie Mac reports the following national averages with mortgage rates for the week ending Aug. 18:

30-year fixed-rate mortgages: averaged 5.13%, with an average 0.8 point, falling from last week’s 5.22% average. Last year at this time, 30-year rates averaged 2.86%.

15-year fixed-rate mortgages: averaged 4.55%, with an average 0.7 point, dropping from last week’s 4.59% average. A year ago, 15-year rates averaged 2.16%.

5-year hybrid adjustable-rate mortgages: averaged 4.39%, with an average 0.3 point, dropping from last week’s 4.43% average. A year ago, 5-year ARMs averaged 2.43%.

Freddie Mac reports commitment rates along with average points to better reflect the total upfront cost of obtaining the mortgage.