In the last two years, the single-family housing market has been hot, with high sales volumes, rising prices and low available inventory. Institutional investors buying up properties for conversion to single-family rentals (SFR) has been cited as factor contributing to this situation. A new report from the National Association of Realtors (NAR) sheds some light on how big a factor these purchases are in the tight housing market.

Are institutional investors jumping in?

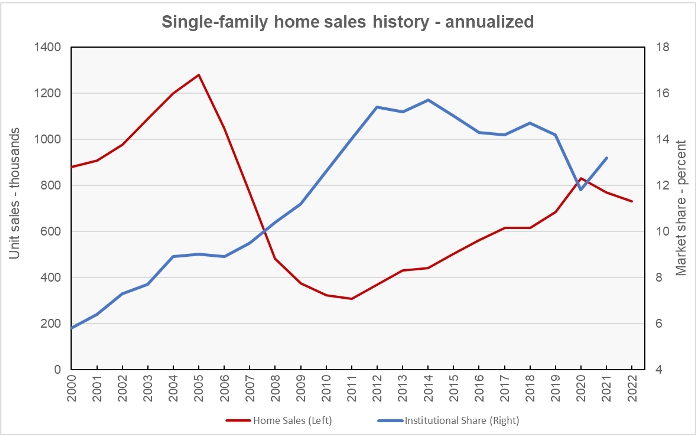

The NAR surveyed 3,644 of its members and found that 76 percent believed that institutional investors were more active in the housing market now, compared to three years ago. However, The NAR’s analysis of data provided by Black Knight tells a different story. That data is summarized in the first chart, below.

The chart shows that the share of single-family homes purchased by institutional investors has been rising since at least the turn of the century and it peaked in 2014 at 15.7 percent. Other than the pandemic year of 2020, the share of single-family homes purchased by institutional investors in 2021 was the lowest since 2011.

The chart also shows the annualized sales volume of new single-family homes for the last 20+ years. Much of the rise in the share of institutional investors occurred after the bursting of the housing bubble in 2007.

Creating single-family rentals

The NAR survey found that only 42 percent of the homes purchased by institutional investors were converted to single-family rentals. Fully 45 percent of the homes were resold as “flips”. The other homes were placed into some other ownership form, such as shared equity or rent-to-own.

The NAR also found that the median price of a home purchased by an institutional investor was 26 percent lower than the median price of other homes purchased in the same state. Institutional investors were also more likely to buy homes that were judged to be in poor condition and to buy homes “as is”. These statistics are consistent with a high portion of institutional purchasers pursuing a flipping strategy.

However, the survey reports that there are significant local variations in the activities of institutional investors in single-family housing. They tend to have a higher market share in fast growing sunbelt regions with fast rising rents, with a share as high as two-thirds of purchases in one county in Mississippi. The institutional share of single-family home purchases in Texas was reported to be 28 percent, by far the highest of all the states.

In areas with higher percentages of institutional buyers, the median prices of homes purchased by institutional investors is higher relative to the prices of homes bought by others. In some cases, it is higher in absolute terms. This may indicate that institutional investors in these areas are more likely to be pursuing an SFR strategy than a flipping strategy, but the survey does not address this question directly.

The NAR reported that institutional investors are also responsible for the construction of a significant number of “built-for-rent” (BFR) homes. In 2021, 59,000 BFR homes were started, representing 5.2 percent of single-family housing starts.

The full NAR presentation contains more detailed information about the regions attracting institutional investors as well as the characteristics of the renters who reside there.

Source: Yieldpro.com