Fannie Mae’s latest economic forecast calls for lower GDP growth and higher inflation in 2022 than in earlier forecasts. Their new housing forecast predicts multifamily housing starts to be higher in 2022 but lower in 2023 than did previous forecasts.

Housing: multifamily up, single-family down

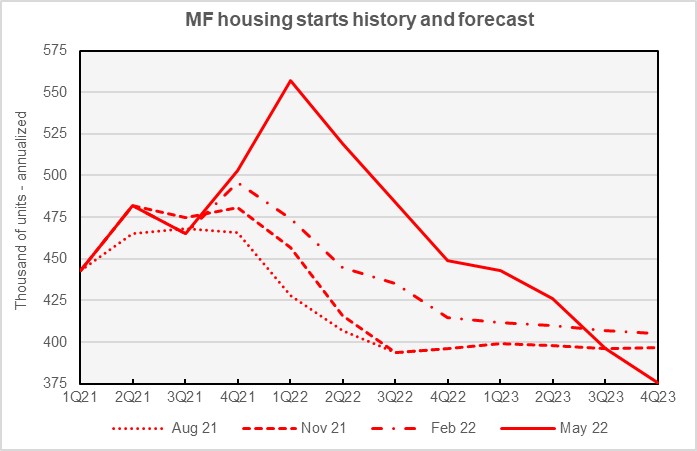

Fannie Mae now expects multifamily starts (2+ units per building) for 2022 to come in at 502,000 units, up 6.5 percent from the number of units started in 2021. This forecast is up 20,000 units from the level forecast last month. The forecast for multifamily starts in 2023 is now 410,000 units, down 16,000 units from the level forecast last month.

The current forecast for multifamily housing starts is shown in the first chart, below, along with three other recent forecasts. The earlier forecasts were selected at 3-month intervals so that the evolving outlook for multifamily housing starts over the last 9 months would be more apparent. The chart shows that Fannie Mae repeatedly revised their projection for multifamily housing starts for 2022 higher, but that they now expect that a slowing economy will lower multifamily housing starts by late 2023.

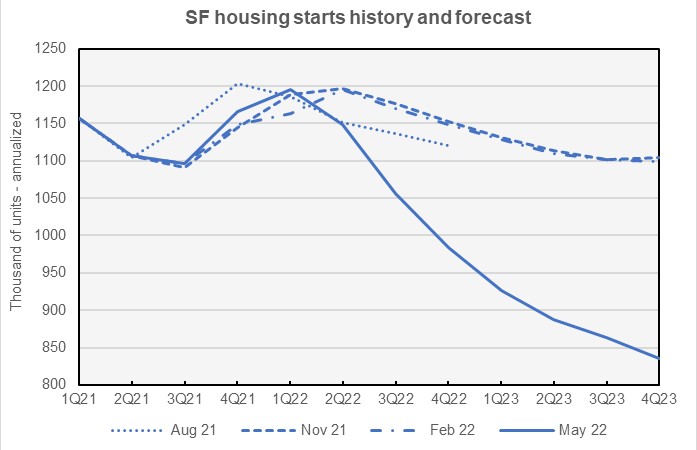

Fannie Mae forecasts single-family starts to be 1,096,000 units in 2022, down 29,000 units from the level forecast last month. Fannie Mae also lowered their forecast for single-family starts in 2023 by 72,000 units to a level of 878,000 units. These revisions to their forecasts are much larger than what is usually seen from one month to the next.

The current forecast for single-family housing starts is shown in the next chart, below, along with three other recent forecasts. The chart highlights the impact that the current expectation for rising interest rates and declining economic growth are anticipated to have on the production of single-family homes.

Inflation forecast to be higher for longer

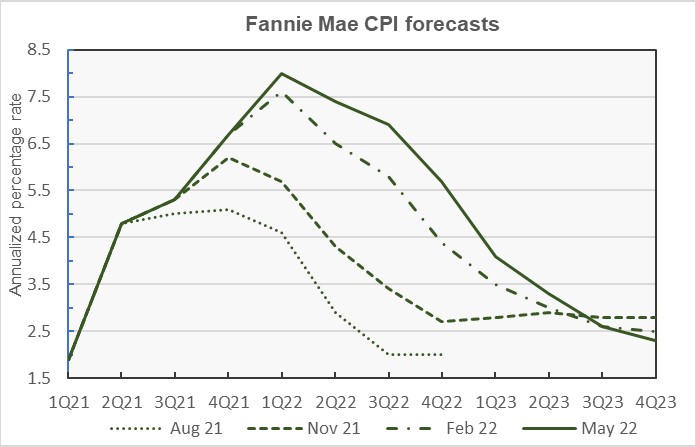

The next chart, below, shows Fannie Mae’s current forecast for the Consumer Price Index (CPI), along with three other recent economic forecasts for the CPI.

The chart shows that forecasters have repeatedly underestimated both the height and the duration of the inflation that broke out in 2Q 2021. Their forecast again projects that inflation has peaked and will be brought under control by the end of 2023.

In this month’s forecast, Fannie Mae raised their inflation rate projections for the next 4 quarters and also raised the overall expected inflation rate for 2022 from 5.5 percent forecast last month to 5.7 percent.

GDP growth forecast revised modestly lower

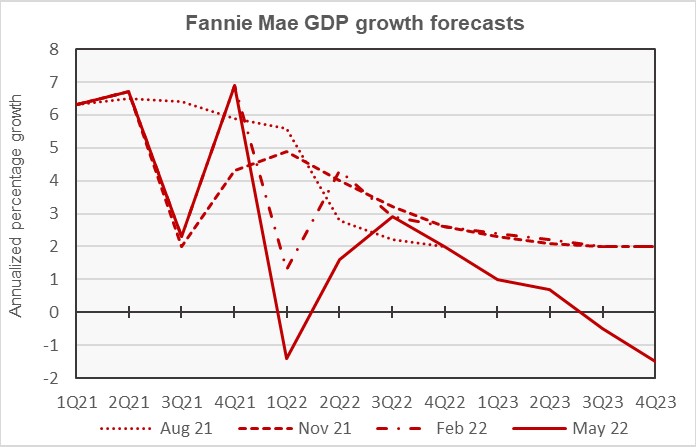

The next chart, below, shows Fannie Mae’s current forecast for the growth in Gross Domestic Product (GDP), along with three other recent economic forecasts for GDP.

Downward pressure on GDP growth is being applied by many of the same factors applying upward pressure on inflation, including supply chain disruptions and labor shortages.

While Fannie Mae had expected an economic slowdown in Q1, negative GDP growth was not expected. The Q1 results caused Fannie Mae to lower their outlook for GDP in each of the next 4 quarters. For the year 2022 as a whole, the GDP growth forecast was revised downward from 2.1 percent to 1.3 percent.

The full-year forecast for GDP growth in 2023 was left unchanged at -0.1 percent, with negative growth in each of the last two quarters of the year.

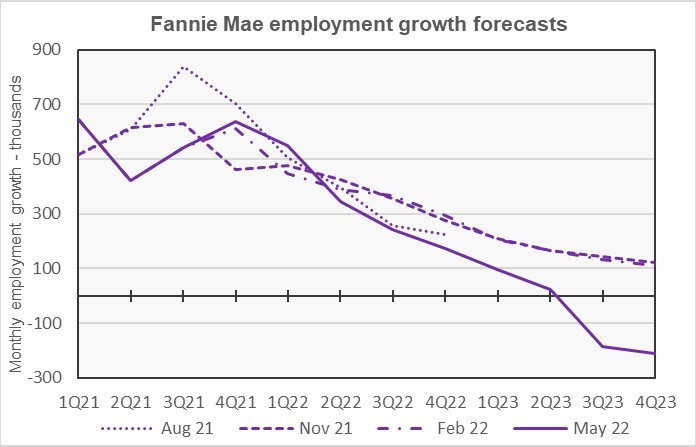

Employment growth forecast lower

The final chart, below, shows Fannie Mae’s current forecast for the growth in employment, along with three other recent economic forecasts for employment growth. The current forecast predicts lower growth in employment for every quarter through the end of 2023 than did last month’s forecast. Fannie Mae now expects the economy to create 500,000 fewer jobs in 2022 than they predicted last month and they expect that the economy will lose 800,000 jobs in 2023 as it goes into recession.

The positive jobs growth in 2022 is forecast to lower the unemployment rate to 3.5 percent in the second half of the year. The unemployment rate is forecast to then rise throughout 2023, reaching 5.4 percent by the end of the year.

Commentary focuses on costs

The Multifamily Economic and Market Commentary for this month focused on the relentless rise in construction costs over the past two years. It is more of a recap of where we have been than a look into the future, but it concludes that, with inflation spreading in the economy, “Even though supply chain disruptions appear to be improving, elevated prices are likely here to stay.”

The Fannie Mae forecast discussion can be found here. There are links on that page to the detailed forecasts.

Source: Yieldpro.com