All these curveballs will further fragment the housing market.

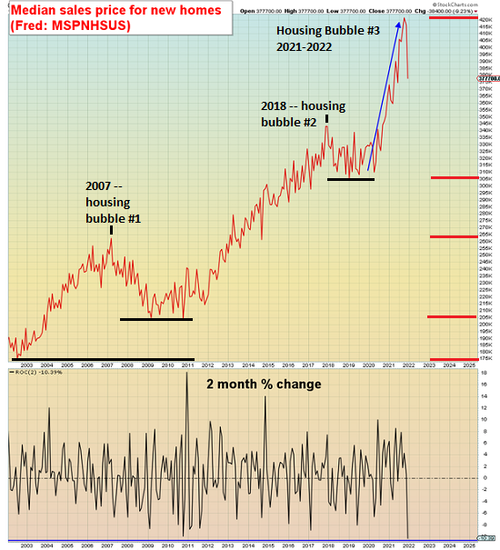

Oh for the good old days of a nice, clean housing bubble and bust as in 2004-2011: subprime lending expanded the pool of buyers, liar loans and loose credit created speculative leverage, the Federal Reserve provided excessive liquidity and the watchdogs of the industry were either induced (ahem) to look away or dozed off in a haze of gross incompetence.

The bubble burst was also straightforward: unsustainable debt, leverage, fraud and speculation all unwound in 2009-2011. The cause was obvious and the effect easily predictable.

Alas, today’s housing bubble and bust has these curveballs:

1. A stupid amount of cash sloshing around the world.

2. Who has the cash and an interest in using it to buy houses.

I considered the two conventional explanations for the current bubble in Is Housing a Bubble That’s About to Crash?: 1) a housing shortage and 2) the Federal Reserve buying mortgage-backed securities and flooding the economy with cheap credit, causing mortgage rates to plummet to record lows.

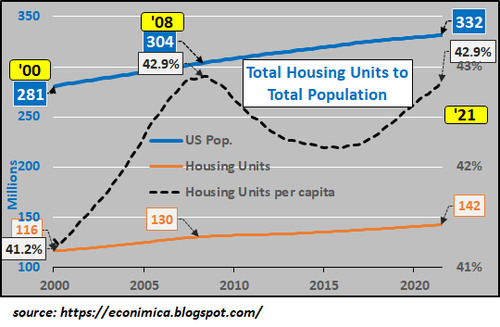

As the per-capita housing chart below shows, the number of housing units per person (per capita) is now at the same level as the previous bubble. This doesn’t support the housing-shortage explanation on a national scale (though local scarcities could be driving prices much higher), and points to a speculative cheap-credit-fueled FOMO frenzy as the primary source of the bubble.

Now that mortgage rates have risen from 3% to 5%, the speculative credit-FOMO bubble is popping.

Unlike the national bubble bust in 2009 – 2011, the current bust will be highly fragmented due to the huge number of wealthy people with stupid amounts of cash at their disposal, thanks to the Everything Bubble that made the already-wealthy much, much wealthier.

The housing bubble will burst in places where buyers must borrow to buy, not where wealthy cash buyers want to live. Those with cash don’t care much about mortgage rates, nor are they terribly sensitive to price. What matters is they get to live where they want to live.

One reason why people with cash will be interested in using it to buy a house is the urban migration is reversing. The rich people who snapped up tony homes in tony urban neighborhoods are quietly selling to the unwary and moving to rural towns and exclusive enclaves far from decaying urban centers.

The places the wealthy want to live don’t want sprawl and new homes sprouting up, so supply will be limited. Locals who preceded the wealthy also have a dim view of sprawl, congestion, overcrowded schools, and all the other blights of building booms.

Strong demand from cash buyers and limited supply equal home prices which don’t drop, they only notch higher. Note that 1) mortgage rates don’t matter to those with stupid amounts of cash and 2) these are not the average speculative buyer, they’re buying for themselves, and are protective of everything that makes the place somewhere they want to live: they are Super-NIMBYs (not in my back yard). “Growth” is fine as long as it’s somewhere else.

A large number of people with insane amounts of cash are not U.S. citizens, and they’re seeking safe havens and nice neighborhoods in places like Canada, Australia and the U.S. Smart populations (for example, Switzerland) place restrictions on foreign ownership for the obvious reason that foreign cash can quickly drive prices beyond the reach of the homegrown populace. Citizens become landless serfs in their own country.

Absent such limits on foreign ownership, housing prices in desirable locales quickly rise beyond the reach of the non-rich and keep on going higher.

Many of these foreign wealthy are escaping capital controls and the potential clawback of ill-gotten gains, and so they are highly motivated buyers.

Corporate owners and buyers are another curveball. Corporations which snapped up hundreds or thousands of rental houses may have confused greed with investing genius, and a nice little recession may leave them with hundreds of vacant homes or newly unemployed renters resisting eviction for non-payment of rent.

As these corporations unload their massive inventory, prices could fall considerably lower than pundits anticipate.

Yet another curveball is urban decay. It’s been roughly 50 years since U.S. cities unraveled in a self-reinforcing spiral of decay, and so the conventional view is rapid decay of basic services and the resulting collapse of housing values is “impossible.” Before making any rash conclusions about “impossibility,” research New York City circa 1971 – 1980.

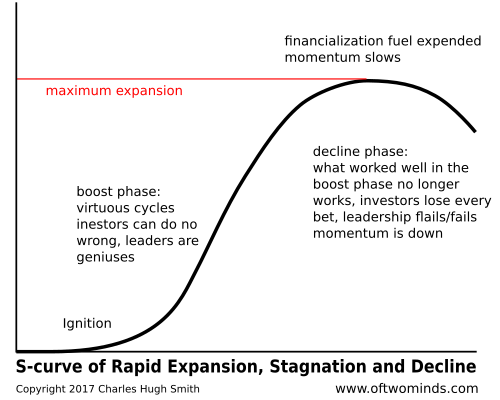

What’s been forgotten is the urban decay of the 1970s was reversed by two one-off miracle-saves: the exploitation of recently discovered super-giant oil fields, which brought energy costs down in the 1980s and beyond, and 2) the hyper-financialization of the U.S. and global economies.

Discoveries of new super-giant oil fields has petered out. The planet has been scoured and there are no more. As for financialization, boosting debt and leverage are now negatives, not positives. There will be no miracle-save by expanding debt, leverage and speculation.

Urban decay–declining tax base and tax revenues, soaring costs and crime and the out-migration of the wealthiest taxpayers–is a curveball few understand. It’s “impossible” until it’s unstoppable. People vote with their feet.

All these curveballs will further fragment the housing market. If national home prices fall 20%, locales blighted by corporate dumping of rentals and urban decay could fall 50% on their way to “impossible” declines. Locales favored by the wealthy with stupid amounts of cash could go up 50%.

Generational and regional inequalities have reached extremes that further fragment the bubble bust. Folks who bought homes for $150,000 decades ago in bubblicious coastal areas are selling out for $1 million in cash, while those who paid roughly the same price in a less-bubble-blessed region have $250,000 after selling– $100,000 less than the current median home price. When you bought and where you bought makes all the difference.

This will drive further fragmentation as the sorta-wealthy with $1 million in cash scoop up the tier below the mega-wealthy. The $2.5 million house in the exclusive enclave is out of reach, but the one for $950,000 in a highly desirable locale is still do-able for the top 5%. Those having to borrow a mortgage and make payments out of wages will have to look for locales that have good fundamentals but aren’t quite attractive enough to be over-run by those with stupid amounts of cash.

Source: Zerohedge.com